How Hamburg is driving the Swedish startup StockRepublic forward

The democratisation of the stock market - that is StockRepublic's vision. Social trading is the name of the business model that the startup from Sweden now wants to popularise in Germany following its great success at home. There are a number of good reasons why it has chosen Hamburg as its location.

From Shareville to StockRepublic: the successful social trading model

Fabian Grapengiesser founded the fintech startup Shareville in Stockholm in 2010. Co-founder Preben Rydin was also there from the start, and software specialist Adam Svanberg joined in 2014. They formed the core of a team that built Shareville into the largest social network for share trading in Scandinavia. The takeover by internet bank Nordnet took place in 2016. However, the trio couldn't let go of the topic of social trading, so they developed the concept for their next startup, which saw the light of day at the end of 2018: StockRepublic.

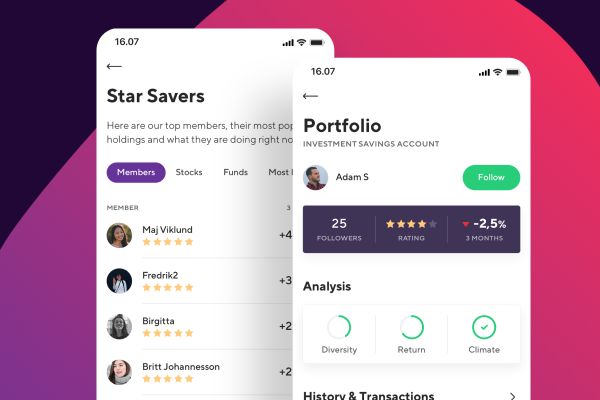

Their customers were financial service providers who wanted to add social trading to their range of services. But what is social trading anyway? The German Federal Financial Supervisory Authority (BaFin) has listed a few characteristics. According to this, it is a form of investment in which investors can view, discuss and replicate the strategies or portfolios of other members of a social network. This is done via an online platform, which can also be used to carry out transactions and manage share portfolios.

First contact made at Fintech Week in Hamburg

It was understood from the outset that StockRepublic would not be limited to Scandinavia. The aim was to cover the whole of Europe, and what could be more obvious than to focus on the German market, the biggest on the continent. In autumn 2019, Fabian Grapengiesser visited Fintech Week in Hamburg and made contact with the comdirect Startup Garage. This is an accelerator run by the direct bank comdirect, where startups go through a three-month funding programme. StockRepublic secured a place on the programme and made a lasting impression.

Maximilian Knopp moved from the Startup Garage to StockRepublic at the beginning of 2022 to build up the German business. At that time, the question of location was still completely open, with the startup capital of Berlin and the financial centre of Frankfurt both up for discussion. But Hamburg also had a good chance from the start, not least because the collaboration with comdirect, based in Quickborn near Hamburg, had led to a concrete result. hi!stocks is the name of the service that comdirect has been offering its three million customers since May 2022.

The app developed by StockRepublic is a prime example of the fintech's services. Customers can use it to disclose their real portfolios to other users anonymously and in compliance with data protection regulations. Performance is always shown as a percentage so that no specific euro amounts or portfolio sizes are visible. Purchases of securities can be made via the app and flow seamlessly into the comdirect custody account. Experience shows that customers were able to increase their returns slightly and, above all, exhibited significantly higher trading activity, which resulted in higher turnover for comdirect.

InnoFintech funding programme tipped the scales

Hamburg has a long tradition as a financial centre. Berenberg Bank, which was founded in 1590 and is still active today, is Germany's oldest private bank. Looking to the future, Finanzplatz Hamburg e.V., the Hamburg Senate and the Hamburg Chamber of Commerce signed a master plan for Hamburg's financial sector on 1 October 2021. The associated measures also included the establishment of a new funding programme by IFB Innovationsstarter GmbH that is unique in Germany. It is called InnoFinTech and is aimed at startups from the financial sector, but also from the legal, property and insurance industries. As part of the programme, up to 90 percent of the costs of eligible projects can be financed with up to 200,000 euros per startup.

The news of the launch of InnoFinTech in March 2022 naturally also reached Maximilian Knopp. The new funding programme provided the final, decisive impetus to open StockRepublic's German office in Hamburg and not in Berlin or Frankfurt. In autumn 2022, StockRepublic applied for the programme and was accepted. This meant not only financial support, but also access to an extensive network and knowledge transfer on all aspects of building a startup. In principle, support from IFB Innovationsstarter GmbH is a seal of quality that can be helpful in attracting customers and investors.

StockRepublic grows in Sweden and Germany

In terms of financing, StockRepublic had its greatest success to date in June 2023. The startup was able to announce a round totalling 2.81 million US dollars, bringing its total investment volume to 5.2 million US dollars. The fresh money came from the Swedish media company Placera Media, which operates the financial website Avanza, among others, and various existing investors and business angels. Sweden remains the business centre of StockRepublic, with the majority of the 35 employees worldwide living here. The German team at the moment consists of four people, but if the current business development continues, it will soon expand.

For further growth, it will be crucial to emphasise the unique selling points of the business model. StockRepublic focuses on a B2B2C concept. This means that its direct customers are banks, while to the actual users of the service the name StockRepublic is kept unknown. This distinguishes the startup from a competitor such as getquin, which moreover does not offer a trading function. The wider competitive environment also includes copy trading providers such as eToro, which offer the opportunity to follow the investment strategies of individuals as well, but have a smaller range of services overall.

The concept is obviously convincing. After comdirect, StockRepublic has now acquired two more clients. The names of the financial service providers remain undisclosed for the time being, but the contracts have already been signed. The Scandinavians are generally said to have a preference for Hamburg, and this certainly applies to the founders of StockRepublic regarding this development. For Germany Managing Director Maximilian Knopp anyway, he grew up in the city and sees Hamburg as an excellent location overall.