HelloBonnie: A very special case of venture clienting

Venture clienting - that's when startups and established companies do business and both sides benefit. In the case of HelloBonnie and the commercial law firm Möhrle Happ Luther, this collaboration is particularly close, as one became a client of the other.

HelloBonnie offers new ways to motivate employees

At the beginning of 2023, business economist Maximilian Roskosch founded HelloBonnie together with computer scientist Niklas Klein. Maximilian had previously worked in strategy and M&A consulting for several years, specialising in the payment and fintech sector, to which he also remained true in his own startup. HelloBonnie addresses the question of how companies can offer their employees additional benefits alongside their salary and ideally save on wage tax and social security contributions. A common example, which is only partially successful, is a gym membership subsidised or fully paid for by the company. For some employees, this is not attractive from the outset, others join zealously at first, but their enthusiasm quickly wanes. In the end, only a minority benefit from this special offer.

There is no single benefit from which all employees of a company profit equally. The HelloBonnie concept is therefore based on the fact that people can decide for themselves which benefits they would like to take advantage of. This ranges from shopping for fashion and food to offers for travel, culture, sport and mobility through to regionally defined areas in which the HelloBonnie payment card can be used. This is made possible by a co-operation with Mastercard. With this selection, there is something for everyone and users can decide each month how they want to combine their benefits.

In theory, the idea is as convincing as it is simple, but in practice it gets more complicated, especially when it comes to the tax details. This is where the commercial law firm Möhrle Happ Luther comes into play. It can look back on almost a hundred years of history. It started in 1928, when Ernst Möhrle set up his own business as an accountant in Hamburg. Today, over 450 people work for the firm at three locations in the fields of tax advice, legal advice, auditing, consulting and IT consulting. One of them is Tobias Müller, partner at Möhrle Happ Luther and an expert in tax matters.

The consulting firm becomes a customer

He was commissioned by HelloBonnie to check which wage tax requirements had to be met in order to make the HelloBonnie Smartcard, which serves as a non-cash benefit card under tax law, a success. By definition, a benefit in kind is additional remuneration in the form of goods or services that a company can grant its employees in recognition of their performance or to encourage motivation. Up to 50 euros per month is tax and social security exempt. In the case of an event-related gift in kind, the limit is a one-off payment of 60 euros. Larger amounts fall into the category of non-cash bonuses, where up to 10,000 euros per year are possible, taxed at a flat rate of 30%.

There are also subsidies and allowances for holidays, meals, education, childcare, health promotion and public transport. All of this together can be significantly more favourable for companies and employees than a normal salary increasenot . The possible uses of the HelloBonnie Smartcard are therefore so diverse that its practicality could only really be credibly established with a test customer. Tobias didn't have to look for one for long. He was so enthusiastic about the idea that he suggested his own law firm for the practical test. This made it possible to immediately determine what worked and what didn't, where legal improvements were needed and how the integration into payroll accounting could be technically managed.

Not all Möhrle Happ Luther employees are authorised to use the HelloBonnie service; not Tobias as a partner, for example. However, around 340 users remained, confirming what the founders of the startup expected and had already experienced with other customers. Acceptance is high, which is mainly due to the high level of flexibility. For example, the entire bonus does not have to be spent month after month, it is also possible to save up for a holiday trip or a more expensive purchase such as a bicycle.

Venture clienting is part of the NCA programme

Flexibility is a good keyword when it comes to criteria for successful venture clienting. Another is trust. Both parties have to adapt to different corporate cultures. Startups rely on speed and trial and error, while established companies often have longer decision-making processes, but bring a wealth of experience to the partnership. Friction can hardly be avoided. It shouldn't be an obstacle if the advatages for all parties involved are clear, even if the interlocking is not always as close as with HelloBonnie and Möhrle Happ Luther.

The Next Commerce Accelerator (NCA) has a wealth of experience with venture clienting. Since 2017, the NCA has been investing in startups that generate added value through digitalisation, among other things in retail. Thorsten Wittmütz, CEO and Managing Partner, has been there from the start. He summarises the four pillars of support in these key points: funding, coaching, access to the startup ecosystem and product-market fit. The last point includes contacts to a number of corporates from the Hamburg metropolitan region that are open to pilot projects with startups - in other words, to venture clienting. HelloBonnie was also able to interest new potential customers in this way.

Good prospects for long-term success for HelloBonnie

One of the biggest challenges in venture clienting for a startup is to turn project partners into long-term paying customers. This is only possible if it not only has a solution for a one-off problem, meaning it only works on a project-related basis, but also offers long-term added value as a service provider. A unique position in the market increases the chances of success. This is the case for HelloBonnie in the German market. Competition from abroad is not to be feared any time soon. Swile is a French company that has been successful with the same business idea. However, due to the very different and complex tax laws from country to country, it is difficult to internationalise the business.

Conversely, this also applies to HelloBonnie, which is why the startup is focussing entirely on Germany. There is also plenty to do here, not all benefit opportunities have yet been exhausted and the HelloBonnie community can help expand the offering with suggestions. Tax law can also change from time to time. But HelloBonnie does obviously have a first-class connection in this area.

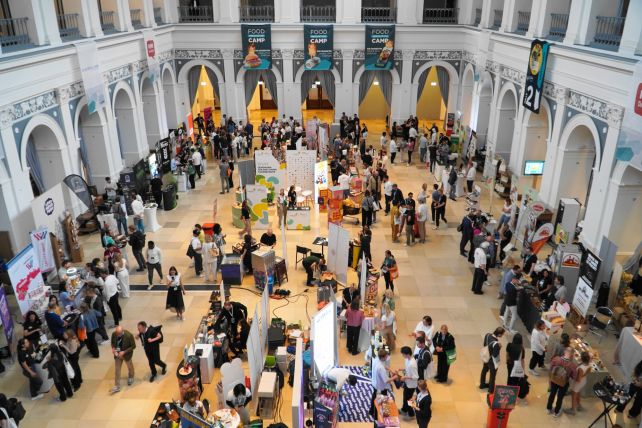

If you want to find out more about HelloBonnie and meet the founders in person, you will have the opportunity to do so on 1 April 2025. This is when the NCA Innovation Day takes place, where 150 startups will pitch and over 800 decision-makers from investment, business and public institutions will be in attendance.