Customers who do not pay their bills can quickly become an existential risk for self-employed people and small businesses, especially since they are often unable to provide effective receivables management for various reasons. The Hamburg-based startup FOMA has recognised this and provides a remedy with a digital self-service platform. With FYRST Bank, it has just been able to win a strong partner for its offer.

FOMA combines innovation with experience

The combination of old and new, of innovation and experience, that's what their startup is all about. At least that's how Stephan Schuller and Lars Helm from FOMA define it. Innovations are part of the self-conception of every startup, and a lot of experience is added when the founders have already passed the age of 50, as in this case. Stephan worked for more than 20 years in leading positions in the financial sector. Among other things, he built up a unit active in 15 countries that handled international claims. Lars has been a lawyer since 2002, also with a focus on receivables management. For this reason, the professional paths of the two future founders of FOMA crossed.

The crises that have been occurring since 2020 - pandemic, supply shortages, Ukraine war, inflation - can bring companies of any size into economic difficulties. However, small and medium-sized enterprises (SMEs) as well as the self-employed, whose financial cushion is quickly eaten up when debtors do not meet their payment obligations, get into trouble particularly quickly. In addition, they often lack the capacity to press their claims. Can digitalisation help here? Yes, Stephan and Lars argued, and developed their business idea in 2021, which led to the founding of FOMA in 2022. They launched their service for real in February 2023.

This is how FOMA's receivables registration works

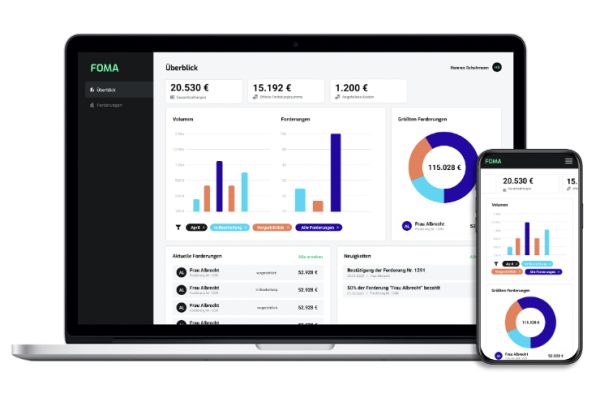

It takes less than five minutes to submit a claim to FOMA - at least that is the promise of the startup on its website. The first step is registration, for which only a few details about the company are required. After that, all relevant data on the debtor and the claim can be entered via an online form. In addition to the mandatory fields, there are others for further information that can increase the chances of success. If there are several claims, they can be entered in an Excel table. For regular customers, it is also possible to set up an interface to the ERP system, which enables automatic data transfer. In this way, FOMA offers a wide range of options for transferring receivables via the most diverse channels in order to meet the individual needs of customers.

And in future it will be even easier, namely by photographing or scanning an invoice. This is where Intelligent Document Processing (IDP) software comes into play. IDP combines classic optical character recognition (OCR) with the very latest AI technology and is also integrated in the new FOMA app, which will be launched in September. In this way, any data from documents such as invoices can be directly captured and processed.

A receivables procedure is always recommended if an invoice has not been paid after at least 30 days and a commercial reminder has already been sent. FOMA then tries to obtain a pre-court debt collection, which can be successful in 80 % of cases. In the remaining 20%, a judicial debt collection procedure is necessary. In both scenarios, FOMA guarantees the following conditions in the "Professional-Tarif": no fees, no minimum claim amount, no membership fee, full payment of the claim in case of success and no lump sum in case of non-success.

There are also other tariff categories with different conditions. In the case of insolvencies, creditors receive 75 % of their claims in the event of success; in the case of old claims, which may date back several years, the rate is 70 %. The law firm Reinfeld und Dr. Hellgardt, where Lars has been a partner since 2009, serves as the startup's legal partner for the collection procedure.

Cooperation partners provide added value and growth

FOMA describes its offer as a self-service platform through which customers can manage their receivables digitally and are informed about the status at all times. Among other things, this is done with a graphic presentation of the pending and already fulfilled claims. In addition, the startup offers an entire ecosystem via its value-added marketplace, which includes individual solutions and the integration of various partners. For example, insurance can be taken out against bad debt losses and cyber attacks, and addresses can be acquired for B2B business. Other services such as a credit rating manager are to follow.

FOMA recently entered into a particularly promising partnership with FYRST Bank. FYRST belongs to the Deutsche Bank Group and mainly addresses freelancers and startups, customers who also belong to FOMA's target group. This cooperation, which significantly increases awareness and thus the number of potential customers in one fell swoop, is not intended to remain an isolated case. Promising talks with other companies are currently underway. This form of marketing is worth its weight in gold for the young company, because so far it has managed completely without external financing.

The advertising budget is correspondingly small and the team compact. At the moment, there are seven permanent members in it, but there are also more than 40 other people who advance FOMA in one way or another with their know-how. The IT area, for example, is mainly in the hands of two external service providers. They are in close contact with Stephan, who is not a trained techie himself, but has gained a lot of experience in this field over the years. Technological innovations play an important role in making customer service even more attractive. One of FOMA's not so unrealistic dreams for the future is a digital avatar created with the help of AI that is almost indistinguishable from a real person and can answer all customer questions.

FOMA benefits in many ways from Hamburg as a location

Against this background, the cooperation with ARIC, which will begin shortly, makes a lot of sense. The abbreviation stands for the Artificial Intelligence Center Hamburg, which promotes various forms of the application of artificial intelligence in the Hamburg metropolitan region. The cooperation includes, among other things, advice on AI issues and support in the search for partners. For this, the joint stand organised by Startup City Hamburg at the OMR Festival in May has already proved extremely helpful. FOMA was able to make valuable contacts there.

So far, Hamburg has shown to be a good place for the young startup. Stephan also mentions the Hamburg Chamber of Commerce and its speaker for finance, Jan Korte, as another important institution. The financial sector traditionally plays an important role in Hamburg and employs more than 50,000 people in the metropolitan region. Stephan is optimistic that this will continue: