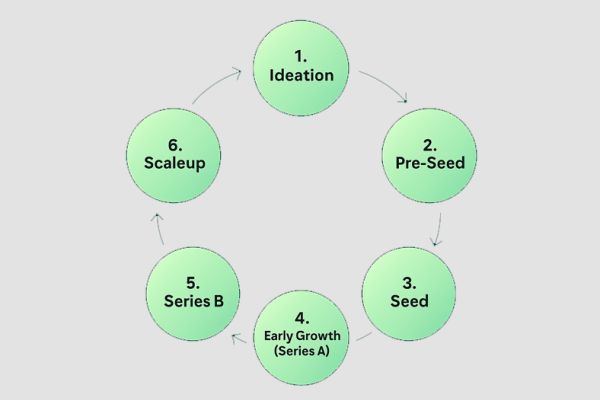

Successful startups don’t just appear - founders build them with clear strategies, relentless execution, and focused investments. Every startup moves through distinct phases, each packed with unique risks and opportunities. From sparking the initial idea in the Ideation Stage to building the product in the Seed Stage and scaling operations in the Growth Stage, each step demands deliberate action and smart planning.

Learn what is key in a particular startup phase

This article explores the six essential stages of a startup journey, outlining the key priorities at each phase. Along the way, you’ll find valuable resources and actionable insights to help building your network, scale your business model effectively, and create long-term success in your market.

1. Ideation: Your first steps into the startup world

Everything begins with ideation or shaping your business idea. Then your startup enters the pre-seed phase. During this stage, you develop your concept, analyze the market, and determine whether your product or service really solves a problem. The objective is to establish a problem-solution fit and lay the groundwork for a sustainable business model. Even if you have yet to raise capital, this is when you plant the seeds for future success.

4 steps for a strong ideation phase:

Identify a real problem: Observe the market, talk to potential customers, and discover an unsolved, real pain point.

Develop first solution concepts: Rough sketches of your product or service are enough to get started.

Test your idea early: Use interviews, surveys, or landing pages to gather initial feedback.

Create a basic business model: Use e.g., the Business Model Canvas to identify risks and opportunities early.

📣 Pro Tip: Build an early believer board

These are people who believe in your idea early and are willing to offer feedback, know-how, and their network—frequently free of charge or in return for small equity shares. Who typically joins? Early supporters like former colleagues, mentors, initial investors, industry experts, potential customers, power users, or other founders who have faced similar challenges.

Purpose & Benefits: They offer honest feedback, strategic sparring, access to valuable networks, and moral support when things get tough. This is an informal group without legal responsibilities.

2. Pre-seed: From idea to first proof

The pre-seed phase is about transforming your idea into a validatable business model. You've already identified a clear problem - now you're building a working prototype, gathering user feedback, and starting to assemble your founding team.

Now’s the time to start talking to investors, business angels and those behind funding schemes. The goal is to achieve Proof of Concept and first market validation.

Key steps in the pre-seed phase:

Understand your target audience: What do your customers truly need, feel, and want? Understand their problems, behavior and buying decisions.

Develop a prototype: Build a Minimum Viable Product (MVP) to bring your idea to life.

Validate the market: Test your MVP on real users, gather feedback, and improve iteratively.

Protect your brand and idea: Learn about IP rights and attend workshops so you can secure your idea or avoid legal risks.

Build your founding team: Look for co-founders with complementary skills (e.g., tech, business, marketing). > to the co-founder-search

Create a pitch deck: Visually present your concept for early investor discussions. > tips on pitching

Secure funding: Look for pre-seed investors, grants, or join an accelerator.

Networking in the pre-seed phase

How to access know-how, capital and contacts:

You need more than just a strong idea in the pre-seed phase. You need expertise, capital, and door openers. And all of this comes from the right network. But how do you build a relevant and valuable network early?

🔗 Warm Introductions

Get introduced to investors or experts through existing contacts. That boosts your credibility instantly.🎤 Attend events & formats

Go to startup events, pitch nights, and demo days – these are often when the most valuable connections are forged. > explore founder events💬 Use LinkedIn strategically

Reach out to people with genuine value to offer. No spam – aim for respectful, meaningful conversations.🚀 Engage early with accelerators & VCs

Even if they’re not ready to invest, start building relationships long before you actually need capital. > learn more about Investors-search📣 Build visibility

Share insights, learnings, or questions on social media – position yourself as a founder with substance and expertise.

3. Seed: From prototype to market-ready product

On completing the pre-seed phase, your startup moves into the seed phase - a crucial step towards market launch. The focus now shifts to building a market-ready product. You’ve already gathered early feedback - now it’s time to refine your solution, gain your first paying customers, and establish a scalable business model. The seed phase often involves the first major investment rounds involving business angels, early-stage funds, or venture capital firms.

Typical goals in the seed phase:

Achieve product-market fit: Develop your product based on real customer needs and behavior.

Test your go-to-market strategy: Launch marketing and sales channels to gain real traction.

Expand your team: Hire your first employees, especially in product, tech, and sales. Look for people who believe in your vision. Optionally, offer employee equity to boost motivation. > check out our free job board

Create scalable structures: Establish clear processes, KPIs, and tools for growth.

Secure seed investment: Prepare for investor meetings and due diligence. Investors often want transparency and influence through an investor or advisory board. It is important not to give up control and remain in charge as the founder. > info on finding an investor

4. Early growth: the series A phase – structured scaling begins

After the seed phase, the Series A stage is a critical growth milestone for your startup. You've achieved product-market fit, generated early revenue, and proven your business model. Now the focus shifts clearly to scaling.

The Series A phase centers on optimizing internal processes, strategically expanding your team, and investing in marketing, sales, and product development. At this stage, investors expect solid KPIs, a strong team, and a clear vision for growth. This is often when institutional venture capital firms enter the picture with larger investment rounds.

Core goals in series A phase:

Scale growth: Significantly increase user base, revenue, and market share.

Build your team: Recruit experienced leaders and specialists for key roles.

Professionalize processes: Introduce systems and structures that support long-term growth.

Explore international expansion: Start preparing for entry into new markets.

Sharpen reporting & KPIs: Investors expect transparency and structured reporting frameworks.

5. Series B: Accelerating growth and conquering new markets

After completing Series A successfully, your startup enters the Series B phase and things start to scale quickly. Your product is established, your internal processes work, and your business model is scalable. Now the focus is on controlled hypergrowth – often including international expansion. The goal is to achieve market leadership and to tap into new revenue opportunities.

Series B is characterized by larger VC-led funding rounds, often in the high-seven to eight-figure range. Investors expect strong metrics, global ambitions, and a professional management team.

Strategic focus in series B phase:

Expand market share: Scale marketing and sales operations at a high level.

Go international: Plan and execute entry into new countries.

Advance the product: Align your roadmap with strategic innovation.

Scale your organization: Create a scalable, future-proof company structure.

Prepare for profitability: Prioritize efficiency, unit economics, and sustainable growth.

6. Scaleup: Scaling at the highest level – or preparing for exit

At this point, your startup has evolved into a scaleup and a serious growth company. It’s no longer simply about expansion; it's about market dominance, global reach, and planning a potential exit. Your company is well-established, generating substantial revenue, and delivering strong KPIs.

Funding rounds in this stage are significantly larger and often involve major venture capital firms, private equity funds or strategic corporate investors. The goal is to secure a huge market share, explore new business areas, expand internationally or prepare for an exit such as M&A or an IPO.

Typical objectives in the scaleup stage:

Global expansion: Break into new regions and customer segments.

Diversify offerings: Develop new products, services, or entire business models.

Professionalize operations: Elevate company structures to corporate level.

Define your exit strategy: Prepare for acquisition, IPO, or strategic partnerships.

Ensure scalability: Build efficient systems for profitable, long-term growth.

Every startup phase calls for tailored actions and a well-thought-out strategy. From early ideation to international scaling, founders who make the right moves at the right time can achieve sustainable growth and long-term success. Leverage funding rounds strategically, refine your internal processes, and invest in your team to elevate your startup to the next level.