Hamburg-based venture capital firm DTCP has closed its third growth fund and its new early-stage fund Incharge Capital, a joint venture with Porsche SE, with a total volume of 450 million US dollars. The main investors are Deutsche Telekom and Japan's Softbank.

Two new funds, one more planned

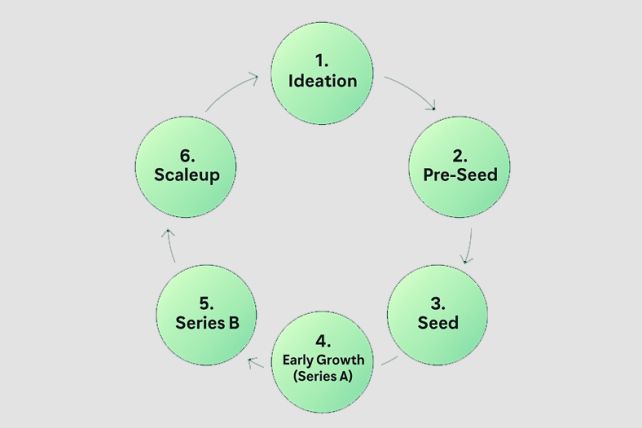

The Growth Equity III growth fund accounts for slightly more than 330 million US dollars. It has already invested in four companies, which are Anecdotes, Cognigy, Cohere and Quantum Systems, all of them focussing on AI and automation. Investments in the range of 20 to 25 million US dollars are planned in fast-growing startups from Europe, the USA and Israel. Incharge Capital Partners, the cooperation between DTCP and the holding company Porsche SE, focuses its financing on technologies and business models from the mobility industry.

A fund is also planned for startups that are at too early a stage for Growth Equity III. DTCP Managing Director Thomas Preuß spoke to the American startup medium TechCrunch about a volume of 125 million US dollars and Berlin as the base.

DTCP was founded in 2015 as an investment platform of Deutsche Telekom, for which the letters "DT" stood. Today, the abbreviation stands for "Digital Transformation Capital Partners", but Deutsche Telekom continues to act as the anchor investor. In addition to Hamburg, DTCP also has offices in Tel Aviv, San Francisco, Luxembourg and London. In total, the company has already made more than 60 investments, including via its Digital Infrastructure Vehicle I & II funds.